Nifty 50 Expiry Hero Zero Trade History of 04 April 20204

The Nifty 50 expiry summary for 04 April 2024 was nothing short of exhilarating, offering traders a wild ride through the ups and downs of the market. In this post, we'll delve into the day's events, exploring the fluctuations in both put and call options prices, and unraveling the lessons we can learn from these movements.

Morning Dip: Put Side Dominance

As the market kicked off its trading day, the morning saw a surge in activity on the put side. Traders were keenly observing the movements, strategizing their positions for the day ahead.

22450 PUT: From Rs. 6 to Rs. 22

The 22450 put option witnessed a steady rise, starting at Rs. 6 and climbing to Rs. 22. This upward trajectory caught the attention of astute traders, signaling potential opportunities for profit.

22450 PUT: A Remarkable Leap to Rs. 190

One of the standout performers of the morning session was the 22450 put option, which skyrocketed from Rs. 18 to an impressive Rs. 190. This substantial increase left traders buzzing with excitement, capitalizing on the significant gains.

22500 PUT: Seizing Opportunities from Rs. 5 to Rs. 32

Another notable move was observed in the 22500 put option, demonstrating a remarkable jump from Rs. 5 to Rs. 32. Traders who capitalized on this upward trend were rewarded handsomely for their foresight and quick action.

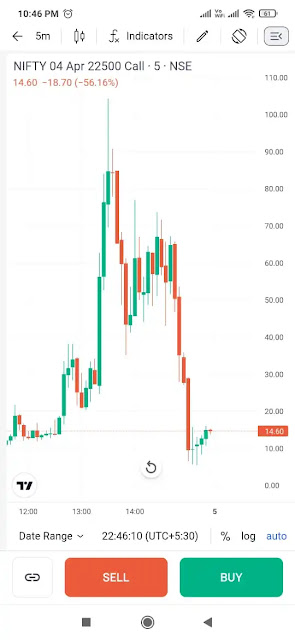

Call Side Rally: Afternoon Surge

As the morning session progressed into the afternoon, the market dynamics shifted, with the call side gaining momentum. Traders swiftly adapted to the changing landscape, capitalizing on the emerging opportunities.

22450 CALL: A Phenomenal Surge from Rs. 17 to Rs. 150

The 22450 call option stole the spotlight with its impressive surge from Rs. 17 to a staggering Rs. 150. This remarkable rally caught many traders off guard, but those who anticipated the move reaped substantial rewards.

22500 CALL: A Thrilling Ride from Rs. 10 to Rs. 105

Similarly, the 22500 call option delivered an exhilarating ride, climbing from Rs. 10 to an impressive Rs. 105. Traders who rode this wave experienced the thrill of witnessing their investments multiply exponentially.

22550 CALL: From Rs. 7 to Rs. 65

The 22550 call option also showcased significant growth, surging from Rs. 7 to Rs. 65. This upward momentum presented traders with ample opportunities to capitalize on the market dynamics and maximize their profits.

22600 CALL: From Rs. 3.75 to Rs. 34.25

The 22600 call option experienced a notable increase, starting at Rs. 3.75 and climbing to Rs. 34.25. This upward movement demonstrated the potential for substantial gains even in lower-priced options.

Closing Fluctuations: Put Side Resurgence

As the trading day drew to a close, the market witnessed a resurgence on the put side, providing traders with one final opportunity to capitalize on the day's movements.

22550 PUT: A Rollercoaster Ride from Rs. 22 to Rs. 70, then Rs. 15 to Rs. 70

The 22550 put option offered traders a rollercoaster ride, initially climbing from Rs. 22 to Rs. 70 before experiencing a brief dip to Rs. 15, only to bounce back to Rs. 70. This volatility presented both challenges and opportunities for traders navigating the market's twists and turns.

22550 PUT: Surging to Rs. 285

In a remarkable turn of events, the 22550 put option surged to an impressive Rs. 285, showcasing the unpredictable nature of the market and the potential for significant gains for those who can navigate its complexities.

22500 PUT: Rising from Rs. 25 to Rs. 240

Traders witnessed a remarkable surge in the 22500 put option, with prices rising from Rs. 25 to an impressive Rs. 240. This significant jump presented traders with lucrative opportunities to capitalize on the market's movements.

22600 PUT: Climbing from Rs. 45 to Rs. 120

The 22600 put option demonstrated steady growth throughout the trading day, climbing from Rs. 45 to Rs. 120. Traders who identified this upward trend early on were able to capitalize on the increasing value of their positions.

22600 PUT: Surging to Rs. 330

In a final flourish, the 22600 put option surged to an impressive Rs. 330, highlighting the potential for substantial gains for traders who remained vigilant and capitalized on the market's fluctuations.

Conclusion:

The Nifty 50 expiry summary for 04 April 2024 was a testament to the unpredictable nature of the market and the opportunities it presents for savvy traders. From the morning dip on the put side to the afternoon rally on the call side and the closing fluctuations, traders experienced a whirlwind of activity, with each movement offering valuable lessons and opportunities for profit.

As traders reflect on the day's events and prepare for future trades, they can draw upon the insights gained from this rollercoaster ride to inform their strategies and navigate the market with confidence and agility.

Happy Trading!

.webp)

.webp)

.webp)

.webp)

.webp)